The Hybrid Long-Term Care Insurance Policy Is One Flexible Solution to Consider

Long-term care (“LTC”) insurance is an insurance product that helps pay for the costs associated with long-term care and generally pays for long-term nursing care not covered by health insurance or Medicare.

What Constitutes “Long-Term Care?”

Typically, individuals who need long-term care are not “sick” in the traditional sense but instead are unable to perform two of the six activities of daily living (ADLs).

Generally, ADLs include:

- Eating;

- Bathing;

- Dressing;

- Toileting (being able to get on and off the toilet and perform personal hygiene functions);

- Transferring (being about to get in and out of a bed or chair without assistance); and

- Maintaining continence (being able to control bladder and bowel functions).

Each long-term care insurance provider may have a specific definition of the activities of daily living so it’s important to review the policy to determine what the requirements are to be eligible for such benefits.

Once long-term care becomes necessary, the source of funding this care becomes a pressing issue for the family. Private pay could result in monthly expenditures of family assets in excess of $10,000.

Buying long-term care insurance is an alternative method to help cover the possibility that you will need help taking care of yourself later in life. Although you can get help through Medicaid, the Federally funded and state-run health insurance program for those with low income and who have exhausted most of their savings.

There are two main reasons people buy LTC insurance:

- To protect one’s savings because long-term care costs can deplete your assets quickly; and

- To provide one with more choices for care allowing you access to better quality of care.

However, buying LTC may not be affordable if you have a low income and little savings.

One common objection to purchasing a LTC policy is the fear that years of paying premiums will be wasted if long-term nursing care never becomes necessary. A hybrid LTC policy can help to address that concern, making it a very attractive form of investment for your future and an important component in your estate planning.

A hybrid LTC policy can even be a good choice for clients with significant assets saved and invested because the self-insure strategy may no longer be the best strategy.

What is a Hybrid LTC Policy?

A Hybrid LTC policy is a newer alternative option that combines a life insurance policy with LTC coverage.

The primary appeal with a hybrid LTC policy is that it promises the policyholder that if they don’t end up needing long-term care or don’t use up all of their benefits, the policyholder’s beneficiaries will receive a death benefit.

Another benefit of hybrid LTC policies is that the policy premiums have become more stable versus the stand-alone long-term care policy premiums.

It’s important to note that a hybrid LTC policy can be more expensive than a traditional LTC policy; however, you’re guaranteed to get some returned value from a hybrid LTC policy. The fear of paying expensive premiums for years, without any return, is greatly reduced.

Additionally, you benefit in not having to pay premiums for the rest of your life, which would be the case with a traditional LTC policy where you could be one financial disaster away from missing a premium payment and then having your policy cancelled.

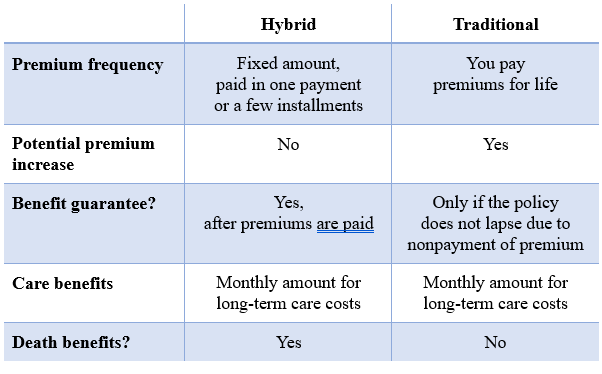

Below is a chart comparing some of the components of both the hybrid LTC policy and traditional LTC insurance:

The hybrid LTC policy may not be a good fit for everybody. That is why it is a good idea to consult with your financial advisor or estate planning attorney about this tool to learn what role it can play in protecting your assets as a part of your overall estate plan.

For a more in-depth discussion on “Hybrid” Long-Term Care policies, please see the below links from Hoover Financial Advisors, P.C. They do a great job discussing the topic in greater detail. They can also be reached at (610) 651-2777 or info@hfaplanning.com if you would like to review your own care and the merits of a hybrid LTC policy.

- “Hybrid” Long-Term Care Policies by Brian Fisher | Hoover Financial Advisors

- An Introduction to Long Term Care by Hoover Financial Advisors

- Long-Term Care Insurance…To Buy or Not to Buy by Hoover Financial Advisors

- Are You Covered? Why Individual Disability & Long-Term Care Insurance are Important by John Heacock | Hoover Financial Advisors

As always, we are available to answer questions and assist you with considering and/or integrating a Hybrid Long-Term Care Policy into your estate planning. Please contact our office at (610) 933–8069.

Check out our other great articles throughout this site that more specifically address the different ways to protect and preserve your assets. Click here for more articles!

If you are a PA Resident: Click here to receive the elder law guides.

Worried about the high cost of long-term care. Click here to subscribe to our monthly elder law e-newsletter.

Worried about the high cost of long-term care. Click here to subscribe to our monthly elder law e-newsletter.

For assistance developing a comprehensive estate plan or nursing home asset protection plan in Pennsylvania, please contact Douglas L. Kaune, Esquire at (610) 933-8069 or email him at dkaune@utbf.com. Doug’s entire practice is focused on elder law, Medicaid application, estate planning, trust planning, estate administration and protection of clients’ assets from nursing home spending and estate and inheritance taxation. Unruh, Turner, Burke & Frees, P.C. is a full-service law firm which has three convenient office locations in Phoenixville, West Chester and Paoli, Pennsylvania. The firm primarily services clients in Chester, Montgomery, Delaware, Philadelphia, Bucks and Berks Counties, but can represent clients throughout Pennsylvania.