You may have seen our recent article about Receiving an Inheritance While on Medicaid in our Elder Law News and Updates Newsletter. That article was an excellent primer on some of the potential problems that can arise when a Medicaid recipient receives an inheritance.

This article is intended to introduce you to some techniques that you can employ in your estate planning to avoid government benefit eligibility problems for your beneficiaries.

Why Is Receiving an Inheritance Problematic for a Medicaid Recipient?

Leaving assets to a beneficiary that is currently receiving Medicaid or other government benefits, or may need to qualify for such programs in the future, could prevent them from meeting the eligibility requirements.

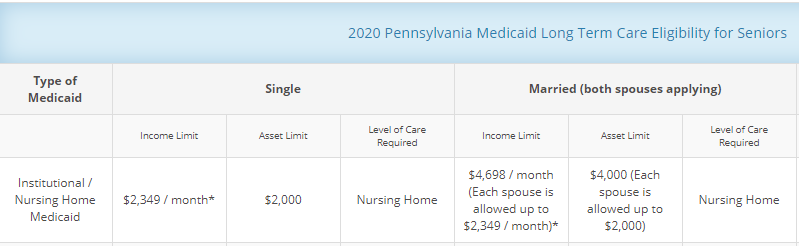

Medicaid, for example, is a “needs-based” program that has strict qualification rules, most notably the income and asset limits. The 2020 Medicaid eligibility limits in Pennsylvania are included in the table below:

If your beneficiary receives an inheritance while on Medicaid, the inheritance would be counted as income in the month that it was received. This typically means that he or she would be over the income limit and would not be eligible for Medicaid during that month.

Any remaining inheritance left after the first month, would be counted as an asset. Medicaid recipients in Pennsylvania must maintain their assets at or below $2,000 (per individual). Receiving even a small inheritance can result in excess assets that will need to be spent down.

Careful estate planning is crucial to protecting an inheritance from government spend down requirements and maintaining eligibility for needed benefits.

How Can I Give Assets to My Beneficiaries Without Impacting Government Benefits Eligibility?

There are no cookie-cutter solutions for Medicaid and other government benefit asset protection. Each family’s situation is unique and requires a thoughtful, specifically-tailored approach. However, there are a number of planning techniques that we utilize regularly to help protect inherited assets and preserve benefits eligibility.

Supplemental Needs Trust

One of the tools that we use to protect assets and preserve benefits eligibility is a Supplemental Needs Trust (SNT). This type of trust is also often referred to as a Special Needs Trust.

The assets in a Supplemental Needs Trust (and the income generated from those assets) are meant to supplement the needs of the beneficiary while allowing them to maintain government benefits.

A SNT that is funded by someone other than the beneficiary is considered to be a third-party SNT. One type of third-party SNT trust is funded at the death of the grantor (the person who is creating the trust). This trust can be funded with virtually all different types of assets.

SNTs which are properly drafted and administered, can protect your beneficiaries who receive MA, SSI and MH/ID benefits from disqualification for these benefits, while also providing a means for providing additional care and comfort as needed. Upon the death of the SNT beneficiary, the remainder of the trust assets will go to the remainder beneficiaries designated by the original grantor and not to the state.

Changing Beneficiaries

Sometimes the most straightforward way to preserve government benefits eligibility for a loved one is by not naming them as a beneficiary at all.

We often implement this type of planning for couples when one spouse enters a nursing home. The spouse that is not in the nursing home is referred to as the Community Spouse for Medicaid purposes.

It is often assumed that the spouse who enters the nursing home (the Institutionalized Spouse) will predecease the Community Spouse. This is not always the case, however. The Community Spouse could pass before the Institutionalized Spouse.

Many married couples have planning in place that directs the first decedent spouse’s assets to the surviving spouse. If the Institutionalized Spouse receives an inheritance from the Community Spouse, those assets would jeopardize his or her qualification for Medicaid or other government benefits.

To prevent this type of scenario, the Community Spouse must update their estate planning and consider leaving assets directly to their children or other desired beneficiaries. These updates would include steps such as changing wills, account title, and beneficiary designations.

Emergency Planning

What happens if you die before implementing the planning described above? Will the inheritance that you left to your loved ones end up being a burden to them, rather than the blessing that you intended? There are options available to your beneficiaries in this situation.

It is never too late to protect some or all of the inherited funds from being spent on care. There are a number of planning approaches that we use to achieve the best results for each of our clients. Some of the most common strategies revolve around the use of spend down options such as burial funds, care contracts, immediate annuities, and gifting. Always consult with an experienced, qualified attorney before implementing the planning that we have described here.

The information outlined above represents only a small fraction of the planning options available. If you want to learn more about how to protect the inheritance that you want to leave to your beneficiaries, contact the Elder Law Solutions® team at Unruh, Turner, Burke & Frees. We have been assisting clients with Medicaid qualification and asset protection for over twenty years. Call us today at 610-933-8069 to schedule an in-depth consultation to review your case and provide you with a custom-tailored plan for your particular circumstances.

Worried about the high cost of long-term care? Click here to subscribe to our monthly elder law e-newsletter.

Check out our other great articles throughout this site that more specifically address the different ways to protect and preserve your assets. Click here for more articles!

If you are a PA Resident: Click here to receive the elder law guides.